When it Comes to Embezzlement, Property Management is Risky Business:

Attached is an article that ran in the Idaho Business Review earlier this week. For the most part, I agree with much of what is said. Is there an epidemic of embezzling going on; I don't think so. Is there a lot of "rob Peter to pay Paul"; I think so. I think licensing of property managers in Idaho would help, but I know licensing won't completely solve this issue. Most states do require licensing of their property managers and although theft of other people’s money still happens, it’s just happens a lot less frequent in those states that require licensing.

Why your money is safe with First Rate Property Management…

- First Rate Property Management is one of three Certified Residential Management Companies in all of Idaho. The certification required policy and procedures, as well as an audit demonstrating how we assure our owner (Client) and tenant (Customer) funds are reconciled.

- We utilize property management software that uses a double entry system.

- Unlike Quick books, we can't just go in and edit bills, checks, and ledgers to make them do what we want. There is no delete or edit. We either do it right the first time, or have to go in and enter an offsetting charge. The system is not very flexible, which keeps us from doing some things that we'd like, but evidently it’s protecting us from ourselves.

- Our system has security levels that deny employee access to areas outside of their department or to the general ledgers.

- Monthly we perform a 3-way reconciliation of funds and balance to the penny.

- Annually, we hire a 3rd party person to perform a full audit of our books.

- Vendor invoices are verified, before a payables clerk processes them and our bookkeeper performs the final check before signing the checks.

- All bank reconciliations are done outside of our accounting department.

- We require owner reserves so that we have the funds to pay bills between the time rents are received and proceeds are released to the owner.

- First Rate Property Management's books are kept on a complete different set of books and software.

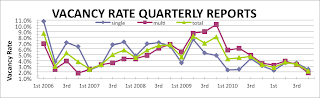

Vacancy is down; NARPM 2011 rent and vacancy report:

Below are two graphs. One shows vacancies from 2006 to 2011 and the other shows average rents for that same time period. Although vacancies are way down, rents have remained relatively flat. One would expect that the rent amounts would be the inverse to the vacancy graph, meaning as vacancy decreases sharply, so would rent. Why is this? For one, I think that after almost a decade of the market being a tenant market, property managers have been slow or cautious to adjust. Additionally, with today's technology, researching and comparing rents can be done within minutes. As a management company, we subscribe to a number of services that go out and find these on-line listings, create an average and some upper and lower control limits so that we can maximize our rents, yet reduce our chances of the property sitting for a month to get that absolute highest rent. Tenants basically do the same thing, but they look at the lowest rent and don't necessarily make adjustments for improvements and other factors that may make one property higher rent than another. I guess you could call it "PRICELINE" for rentals, but just not quite a formal. It’s too bad Boise property managers don't use the MLS as it certainly could help other property managers in analyzing comps and determine a more fair market rent to ask. And lastly, I believe that the supply of rentals has been slowly increasing to keep up with that demand, therefore not allowing that sharp increase in rents one would expect with such low vacancies. Nonetheless, I do however still believe that we will see slight rent increases in 2012.

Click to enlarge images

Our Reader Base:

Initially, our blog was just an easy way to convert First Rate Property Management's monthly newsletters into an electronic format. Over the years, our blog has become a resource to many. Our current subscribers consist of: mortgage lenders, insurance agents, would-be investors in the area, other property managers within the Boise area and as far away as New Jersey, local and out-of-state Realtors, vendors, friends of clients, and even a couple tenants have subscribed to the feeds. Although no one ever posts comments within the blog, the FRPM staff and I receive emails all the time regarding our posts, the feedback and recommendations are always great. So I encourage you to continue to forward these blog entries to others. If they are looking to invest, these certainly can help them understand the market or maybe just a topic here and there will be of benefit.